E-Commerce exports from India: The engine for USD 1 trillion goods exports by 2030 – Part 2

This is the second part in the two part series where we are looking at the e-commerce exports from India. The first part had set the context, and the second part now delves into the policy and regulatory aspects. The post was originally published here: https://swarajyamag.com/business/e-commerce-exports-unlocking-the-potential-of-indias-msme-sector-in-international-trade

Imagine a rural artisan in India effortlessly connecting with an international customer, focusing solely on perfecting her craft while the system handles everything from product listing to payment settlement. This is the transformative potential of e-commerce exports, empowering MSMEs and entrepreneurs to participate in the global marketplace, aligning with the Prime Minister's vision of "Vocal for Local, Local for Global." However, realizing this vision requires a robust framework that addresses the unique challenges and opportunities of digital trade. In this second part, we explore the key elements needed to create a system that unlocks the potential of India's MSME sector in international trade, specifically for goods ordered and paid for online but delivered across borders.

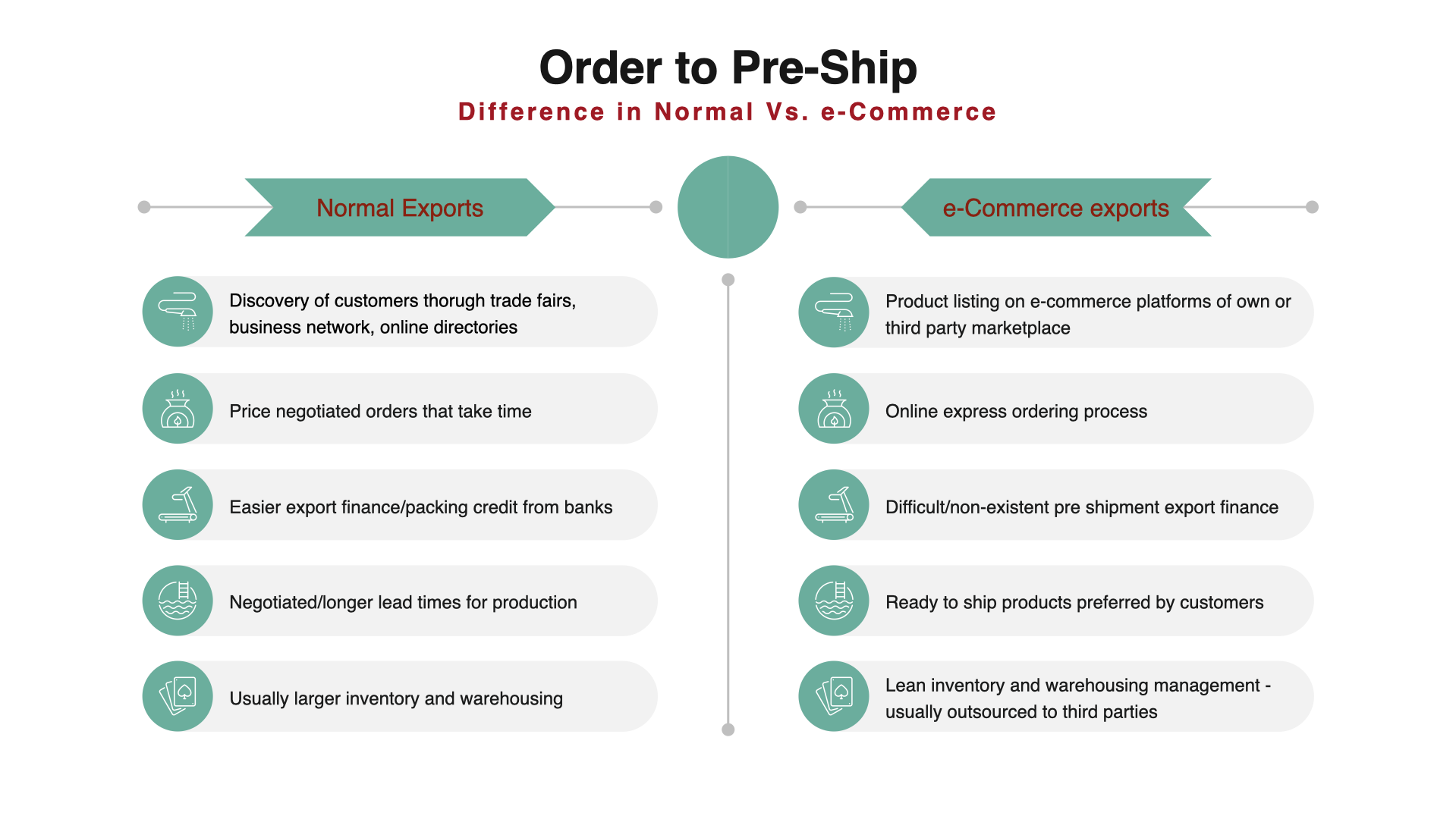

An e-commerce export business is usually a high frequency low value transactions business and comes with different set of challenges when compared against normal exports. The rules of international trade, however, were designed during slower sea-trade era. We shall follow the product journey path in three stages to discover issues and discuss solutions. The first stage is from order to pre-ship processes as shown below:

|

| Table1: Order to pre-ship process differences |

India has highest mobile penetration in the world, combined with one of the cheapest data costs. This makes it easier for rural artisans and MSMEs to connect to the world. Online retail listing of products, either on a customized website or on the third party marketplace like Amazon or eBay, solves the first big puzzle that most starting out small exporters face: Where do I get the order for my products? In the coming years, ONDC may go international and provide a cheaper alternative to list products online. A key challenge for a starting exporter is to understand how to present, catalogue and list their products online.

Normal exporters can obtain packing credit from banks by presenting orders in hand, while e-commerce exporters struggle to secure such credit as they maintain ready-to-ship inventory without pre-existing orders. This calls for a change in how banks approach export credit financing for e-Commerce exporters. The Government's recent initiatives on allowing account aggregators is a positive step. Fintech firms are now leveraging aggregated bank transaction details, order history, and API-based data from GSTN and the IT department to assess creditworthiness. This enables them to enter the small ticket lending market without collateral from e-commerce and small exporters. By pooling large datasets from interconnected systems, these fintech firms can revolutionize the lending sector, either by lending themselves or acting as credit rating providers for large banks to assess MSME creditworthiness.

The second stage of journey including shipping and documentation is shown below:

|

| Table 2: Shipping and documentation differences |

Many e-Commerce exporters lack awareness of regulatory compliance, Partner Government Agency (PGA) certifications - such as organic sourcing or handicrafts certification - and destination regulatory compliances. Most beginners therefore resort to costly fulfilment models run by international marketplace players, out of sheer lack of alternatives, taking a hit at their bottom-line.

Also, to cover various risks, normal exporters often secure export insurance through ECGC when shipping goods, while e-commerce exporters are usually not covered for export credit insurance by such bodies.

To address the knowledge gap on compliances, the Government has launched various initiatives in collaboration with partner agencies and departments, such as Directorate General of Foreign Trade, India Post, CBIC, Department of MSME, and state governments, as well as private sector players including Banks, Logistics service providers, and e-Commerce marketplaces. A noteworthy initiative is the "Districts as Export Hubs" program, which was introduced based on the idea of a district being the primary exporting unit, as outlined in the Prime Minister's Independence Day speech of 2019. This program focuses on export planning from districts and outreach/education to bridge the knowledge gap and has gained momentum in recent months. The Commerce Minister recently launched a handbook for beginners and MSMEs in e-Commerce exports to further support these efforts. In addition, an information and workflow portal named “Trade eConnect” platform is being developed to help MSMEs enter international trade.

Coming to the final stage of post shipment processes the differences are summarized below.

|

| Table3: Post shipment processes |

Trade finance instruments such as post shipment credit, factoring services and bill discounting are available for normal exporters. The e-Commerce exporters are devoid of any of these. The solution to this problem is again through emerging FinTech firms who are also venturing into trade finance areas. The Factoring regulation amendment Act passed by the government during 2021 has played a significant role in encouraging this trend.

One notable pain point is that of compliances under Foreign Exchange Management Act (FEMA) and banking charges associated with these compliances. Each export transaction is reported to RBI by Customs ICEGate system online. This information resides on EDPMS (Export Data Processing and Monitoring System) server of RBI and needs to be accounted against remittances that’s received in the bank accounts of the exporter. When remittances hit the bank account from abroad, the exporter needs to approach the bank and submit necessary export documents to the bank, which in turn verifies the details, and then knocks off the outstanding on EDPMS against the receipt. Not doing so, within stipulated time, attracts penal provisions under FEMA and threat of action by Enforcement Directorate. Banks typically charge between Rs 300 to 700 (or more) per transaction as fee for this service. While this is a small fee for large exporters whose transactions are in thousands of dollars each, it is unviable for small e-Commerce exporters whose transactions are in tens of dollars each. Similarly, for getting benefits under the Foreign Trade Policy of India, or other refunds such as Drawback or GST refunds on exports, electronic Bank Realization Certificates (e-BRC) needs to be generated by banks, which is again a paid service with similar cost structure.

The initiative by the DGFT to come up with free self-certification based e-BRC generation process is a revolutionary step towards easing e-BRC generation process. However, the EDPMS knock off continues to be a pain for e-Commerce exporters and work is under process by the RBI to simplify the same. An alternative solution could be to exempt transactions up to a limit for such statutory compliances, including the time allowed to realize the export proceeds. This issue is being actively examined by the government.

|

| Fig1: India is yet to develop robust e-commerce export statistics capture system (Source: UNCTAD) |

In addition, the government has clearly articulated its intent to extend all export related benefits and refunds normally available to exporters to e-Commerce exporters too. This was done through necessary amendments to the Foreign Trade Policy of India during the revision last year (FTP-2023). Provisions are being gradually rolled out through necessary enablement in the online systems for e-Commerce exporters.

This brings us to the final part of the discussion about what more could be done to promote e-Commerce exports.

The first step for any policy intervention is to ensure good data. We don’t have reliable data on e-Commerce exports. The documents are same for all types of cross border trade. One solution could be to introduce specific customs purpose codes for e-Commerce as done in China. Any exports going under these codes would be counted as e-Commerce exports. Another potential solution could be to introduce an identifier on the existing export documents such as shipping bills which identify an export as e-Commerce export. These may be on self-declaration basis to begin with – and incentives such as faster customs clearances and easy GST refund mechanism may be introduced to encourage correct declaration.

Another significant intervention could be to allow E-Commerce Export Hubs – customs bonded zones on the lines of Export Oriented Units Scheme for easier cross border e-Commerce transactions – for aggregators who in turn may in turn rent out space for retail e-Commerce players. Such zones may also facilitate easy return and minor rework and repackaging of products and would be a good draw for e-Commerce sectors such as custom apparel where return percentage is higher than normal. China tried this model through it's cross-border e-commerce comprehensive pilot areas (CPA). Due to the success, there are now over 105 CPAs in China. CPAs integrate logistics players, payment aggregators, customs and regulatory functions and processing zones under one zone, allowing seamless e-Commerce movement across borders once a good reaches a CPA.

Another significant progress is being undertaken by the Department of Posts and Central Board of Indirect Taxes and Customs (CBIC) through the Dak Niryat Kendra (DNK) initiative, wherein the small exporters are able to electronically file a Postal Bill of Export and then present the parcel at DNK for export. Postal department currently operates over a thousand DNKs in hub-and-spoke model to feed into Foreign Post Offices. A distribution of currently operational DNKs state-wise is shown below demonstrating the reach of India Post and the potential this offers to connect rural India to the world.

Figure 2: Original Tableau Public at: https://public.tableau.com/views/DNKs_in_India/Sheet1?:language=en-US&publish=yes&:sid=&:display_count=n&:origin=viz_share_link

Today we stand at the threshold of a new era for India's trade. The digital landscape opens vast avenues for rural artisans and MSMEs to reach across borders at a scale never seen before in mankind’s history. Embracing this wave of digitization demands regulatory agility and foresight in policy-making, to ensure that India's unique strengths in connectivity and human capital are harnessed fully. Initiatives such as ONDC, FinTech innovations in lending, and customs reforms are harbingers of a more inclusive and prosperous trading future. It is a path that, if navigated wisely, will not just meet the ambitious export targets set forth but also pave the way for India to emerge as a global e-commerce powerhouse in coming years, fulfilling the vision of the Prime Minister in making each district of India an export hub.

This is a good idea! I commented on the article at Swarajya Magazine online and also made a post on Facebook.

ReplyDeleteSometime back, I posted on Facebook, how Andhra Pradesh and Telangana can encourage their small businesses to export their products. I will be glad to send you the links, if the author or any other Indian business person is interested viewing the same.

Thank you. Kindly share the links you mentioned to me at tirumalakv@gmail.com.

DeleteSir, you have rightly pin pointed the issues being faced by back to town /returns process and e-BRC mechanism. The idea of having a minimum let off value for transactiosn is most welcome. It will help solve the problem of not only small exportrs in ecommerce but also in other industries doing exports. There can be an interactive software mechanism which exactly defines the HSN code for the importer/exporter. This if implemented will eliminate the financial ramifications for thr industry if notified wrongly.

ReplyDelete